When several Post Office victims joined us, a group of banking fraud victims, At Westminster in Debating Room 14 last year, we held detailed discussions about the striking similarities in our experiences. In particular, we discussed how regulatory and law-enforcement bodies — including the Financial Conduct Authority, the National Crime Agency, and in my own case Norfolk Police — appeared to have failed to act impartially, instead seemingly protecting Lloyds Bank from scrutiny. Despite repeated attempts to raise this banking scandal through debates in the House of Commons, the issue has consistently been deflected, delayed, or quietly sidelined, with no meaningful investigation or accountability forthcoming. Drawing on their own hard-won experience, the Post Office victims explained that official channels alone rarely deliver justice when powerful institutions are involved. They advised that what ultimately forced action in their case was sustained public exposure through a compelling documentary and short film, which brought national attention, public outrage, and ultimately shame upon the establishment, making continued inaction impossible.

On 27th November 2013, I alerted my bankers — with whom I had maintained a professional relationship for over 30 years — that I required urgent assistance concerning possible illegal activities occurring within a secondary business account, allegedly perpetrated by my Financial Director.

Rather than offering the support and guidance I expected, Lloyds Bank instead appeared to turn against me. I was effectively targeted by their Business Support Unit (BSU), which operated in a manner that felt more punitive than protective — as though I had been “thrown under a tank” manned by their own internal forces.

Despite this pressure, I continued to fight to protect my business and reputation. In response, Lloyds seemed to escalate matters further, involving various questionable individuals and disingenuous associates who appeared determined to undermine me completely.

During this ordeal, I experienced what felt like intimidation and obstruction from Norfolk Police, who — from my perspective — did not act in accordance with the law or demonstrate impartiality. Feeling cornered, I sought help elsewhere.

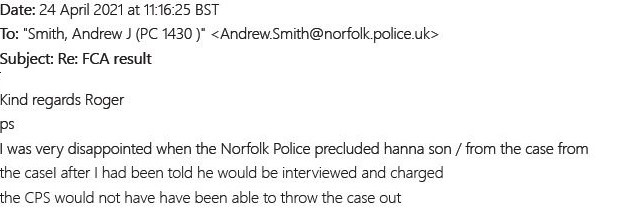

In my search for justice, I joined Trevor Mealham and the Action4Justice demonstration held at the Financial Conduct Authority (FCA) headquarters in Stratford. I effectively threw myself on the mercy of the FCA, the government body responsible for maintaining fairness and integrity within the financial system.

At that time, the FCA was headed by Andrew Bailey (who is now the Governor of the Bank of England). However, rather than receiving genuine assistance, I was referred to the Business Banking Resolution Service (BBRS) — an organization I later discovered had close connections to Lloyds Bank. This left me feeling as though I had been placed before “a pack of hyenas,” rather than a fair and independent tribunal.

Compounding matters, I became aware that the National Crime Agency (NCA) appeared to be suppressing evidence related to money laundering. Meanwhile, a small number of Members of Parliament — including Liz Truss, William Wragg, and a few others — took an interest in my case and made efforts to advocate on my behalf.

Unfortunately, their attempts were met with resistance from within their own party and from figures such as Tom Tugendhat, who appeared to block these efforts. It became increasingly clear to me that powerful interests — the so-called “1%” — were using their influence within both political and financial institutions to silence or marginalize individuals like myself who sought accountability and justice.

Both Liz Truss (then briefly Prime Minister) and William Wragg faced criticism from within their party for trying to help expose these issues, suggesting a troubling culture of suppression and loyalty to entrenched interests rather than to justice or transparency.

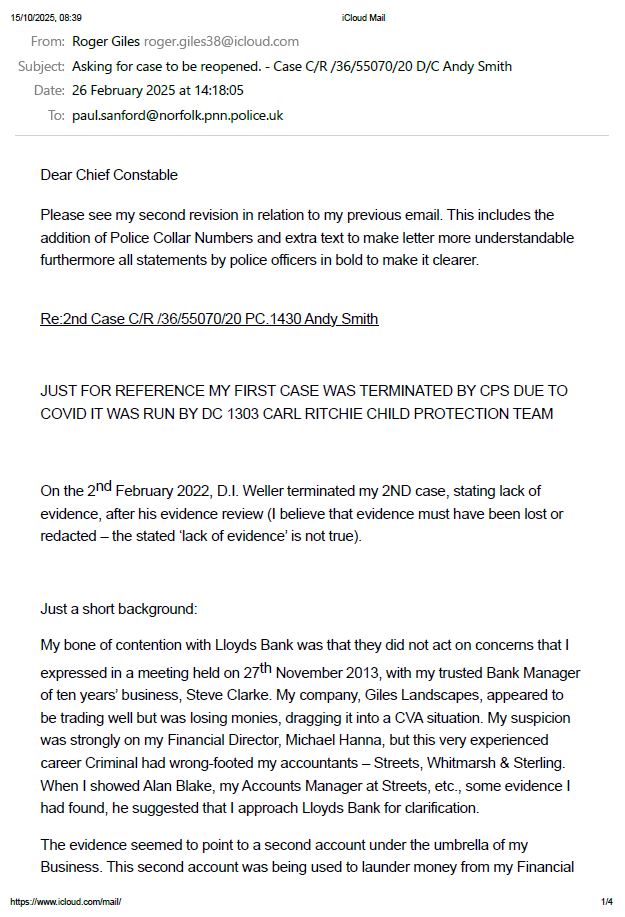

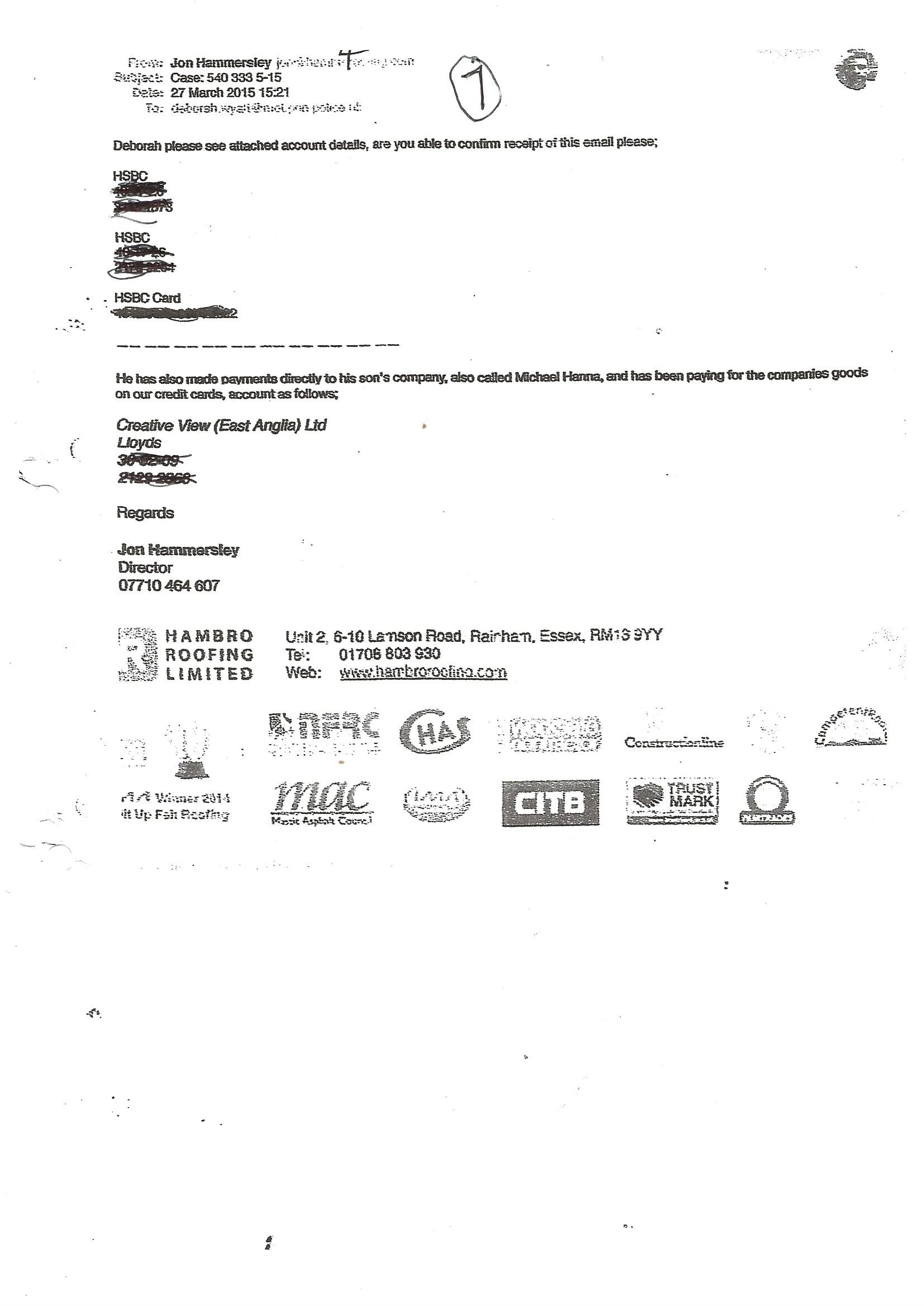

Click here to view attachments sent in this email.

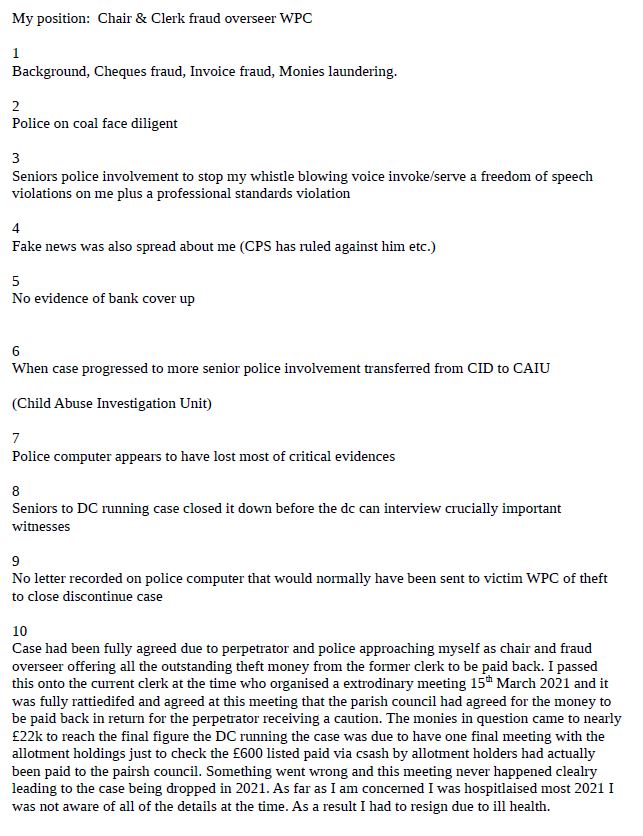

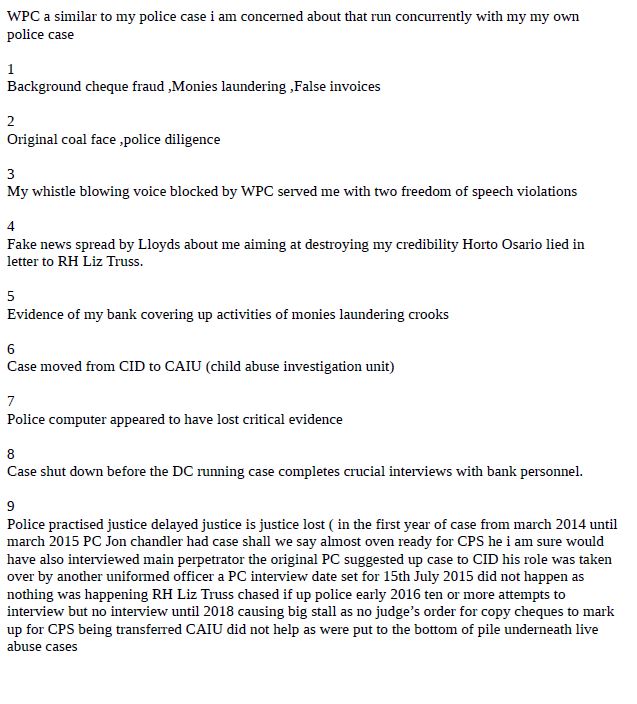

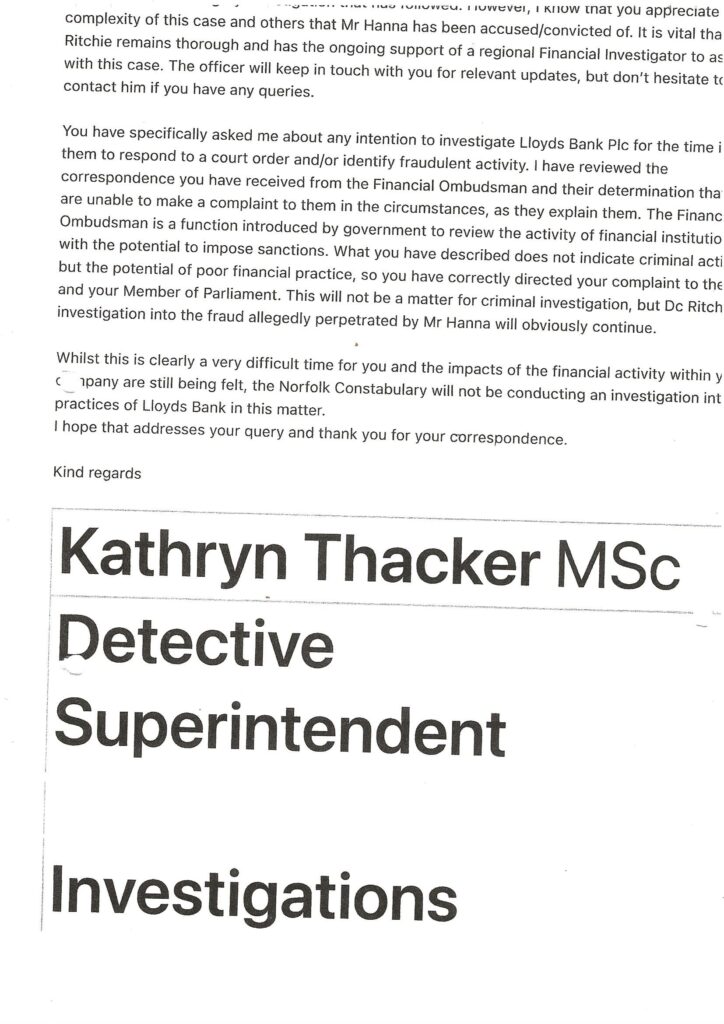

Super Intendent Thacker of the Norfolk Police set a president after seeing evidence of money laundering and cheques being paid out of my account before the bank had issued the numbers to me. Super Intendent Thacker has stated by email this is bad banking practice not criminal activity. Therefore the IPCC, IOPC and OPCC have just obviously played follow the leader.

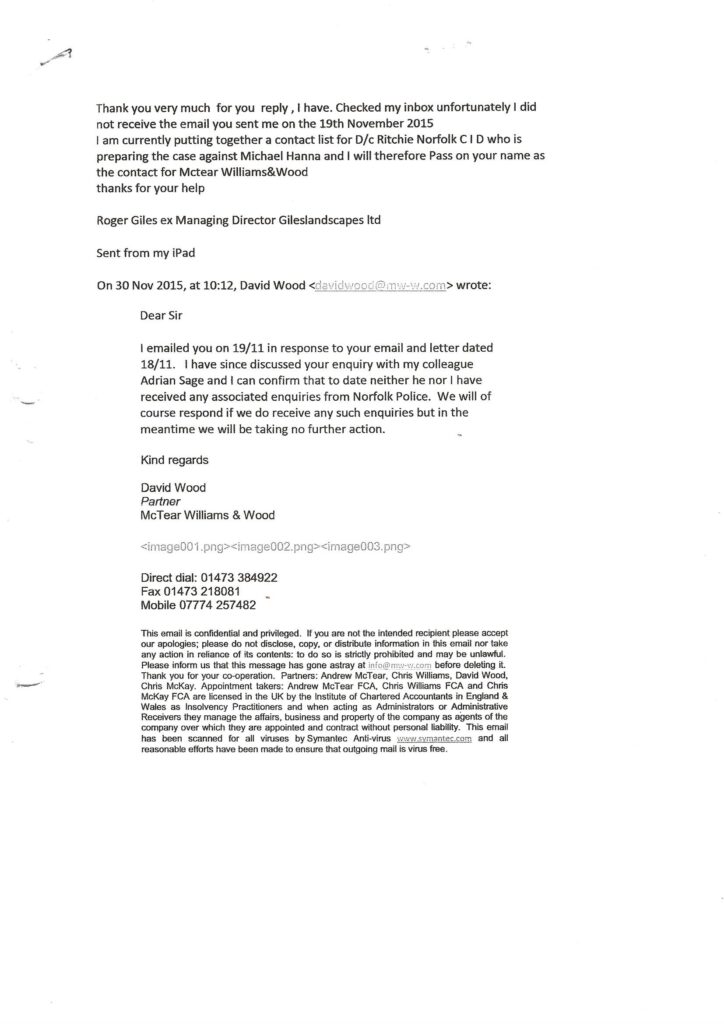

Email Received – 7th February 2022.

Monday 7th February 2022

Re: Litigations against Lloyds Bank et al

Dear Mr Giles

I am Detective Inspector Richard Weller, I am the officer in charge of the Criminal Investigation Department for West Norfolk. I was made aware of your request for us to investigate the conduct of Lloyds Bank Plc and others in relation to their business dealings with you and your company. I am also aware of the fraud that pre-dates this that caused the original financial difficulties of your business (36/55070/20) linked to Hanna.

(My views on the above paragraph) – D. I. Weller should have added that if Lloyds Bank’s Business Support Unit (BSU) had not “put the shutters up” against Mr. Giles on 27 November 2013, when he formally raised his concerns, the outcome could have been very different.

At that time, Mr. Giles had reported serious issues — including suspected money laundering, criminal misconduct, and other nefarious activities — but rather than investigating these matters, Lloyds allegedly moved to suppress his complaints and isolate him from any further communication.

This deliberate obstruction occurred eight months before his well-established and strongly branded business ultimately collapsed. Had Lloyds acted transparently and responsibly instead of concealing wrongdoing, Mr. Giles’s business would almost certainly have survived.

By late November 2013, Mr. Giles had successfully restored most of his company’s sabotaged operational processes, and there was a real opportunity for recovery. However, the main source of ongoing sabotage at that point came directly from Lloyds itself, whose actions effectively crippled his efforts to stabilize the company.

At the time Mr. Giles sought assistance from Lloyds Bank, he had not yet terminated the employment of his Financial Director, as he was still hoping that Lloyds could collaborate with him to uncover and address the fraudulent activities being carried out. Mr. Giles believed that, by working together, they could identify and apprehend the individual responsible for these nefarious acts. However, it has since become apparent that Lloyds Bank had little interest in exposing the situation, as doing so would have reflected poorly on the bank for allowing such illegal activities to occur under its watch.

Mr. Giles further asserts that this reluctance from Lloyds was influenced by the intense scrutiny the bank was already facing from Anthony Stansfeld and his investigative team, who were actively pursuing the truth about the HBOS fraud and associated misconduct. Given this pressure, it seems evident that Lloyds wished to avoid any additional publicity that might connect the institution to further financial impropriety, including money laundering and other illicit activities.

The CPS reason for dropping the above case as it had clashed with COVID and courts would not be reconvening for sometime the main perpetrator would have been dead there was no point in continuing with the case. But in point of fact the main perpetrator who was the beneficiary of much stolen monies from Mr Giles and another victim in Essex was pruned out of my case by the Norfolk Police suggesting it would have been to complicated to have kept him in the frame. But Mr Giles points out if the main perpetrator son would have been included the CPS would have not terminated the case as he was still alive.

I am aware that you provided boxes of material to the PCC’s office in relation to the Lloyds Plc dispute which did contain a small amount of material relevant to the Hanna fraud.

Evidence of Bank Fraud

Please see attached evidence of bank fraud in connection lending these assessors that were bought in by Lloyds my account was debited £6,000 for the privilege of this also it contains evidence of unsoluburicius consultants that appear to be shall we say double agent.

See below video posted on Channel 4. GRG is a carbon copy of the disingenuous Lloyds BSU Department

Three Police Computer anomalies.

1) The WPC case police computer appears to have lost majority of financial evidence

2) The Police computer lost evidence of my £400K case in connection with former financial director with the under current of my Lloyds allegations on the way to the CPS this was the final nail in my coffin of this case which the police had assured me was a very sound case.

3) Roles Building last year Lloyds Vs Trevor Mealham the court/police computer had all Lloyds bundle of evidence on it but somehow had lost Trevor’s evidence.

The conclusion to the above anomalies is all the evidence has been lost is there a similar connection as there was a malfunctioning computer in the recent Horizon scandal. Or is the lost due to human intervention with physical redacting of evidence

It it most important to look into the abbreviations page which be found HERE. Some of the terminologist light gas lighting and DARVO I was not strongly aware of until going on protest and mixing with numeral others who were in the same boat realising Lloyds bank played these cards as a well as continual disruption card.

Information to show ample scanned in evidences for the police but at all twists and turns i seemed to be blocked. Please note as the website gets further constructed there will be a similar situation with the local fraud case.

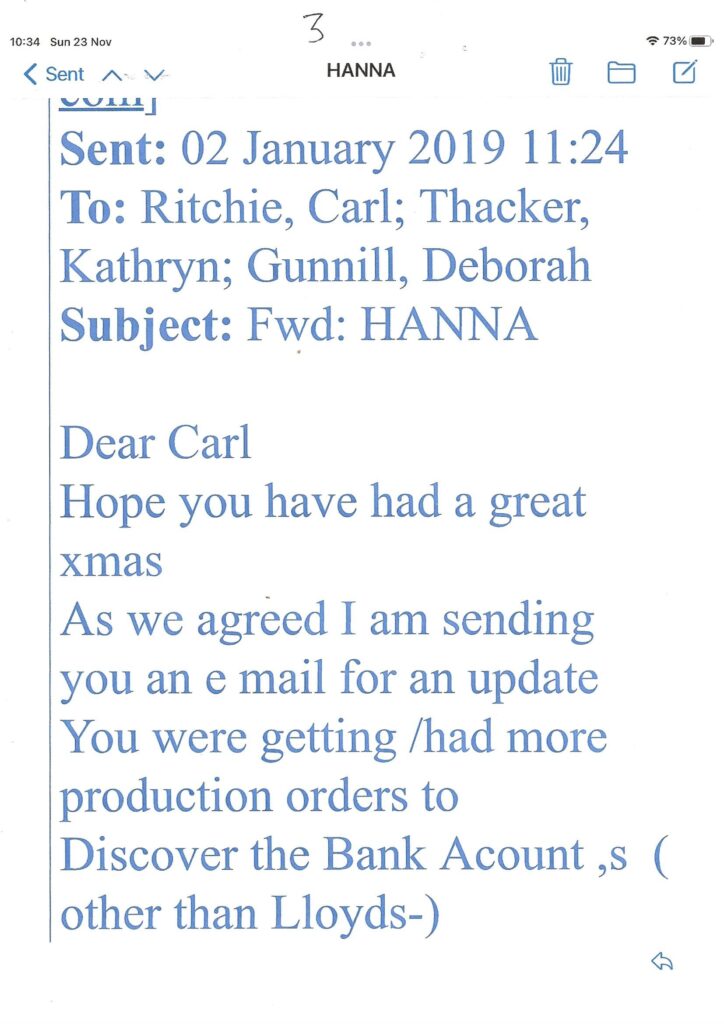

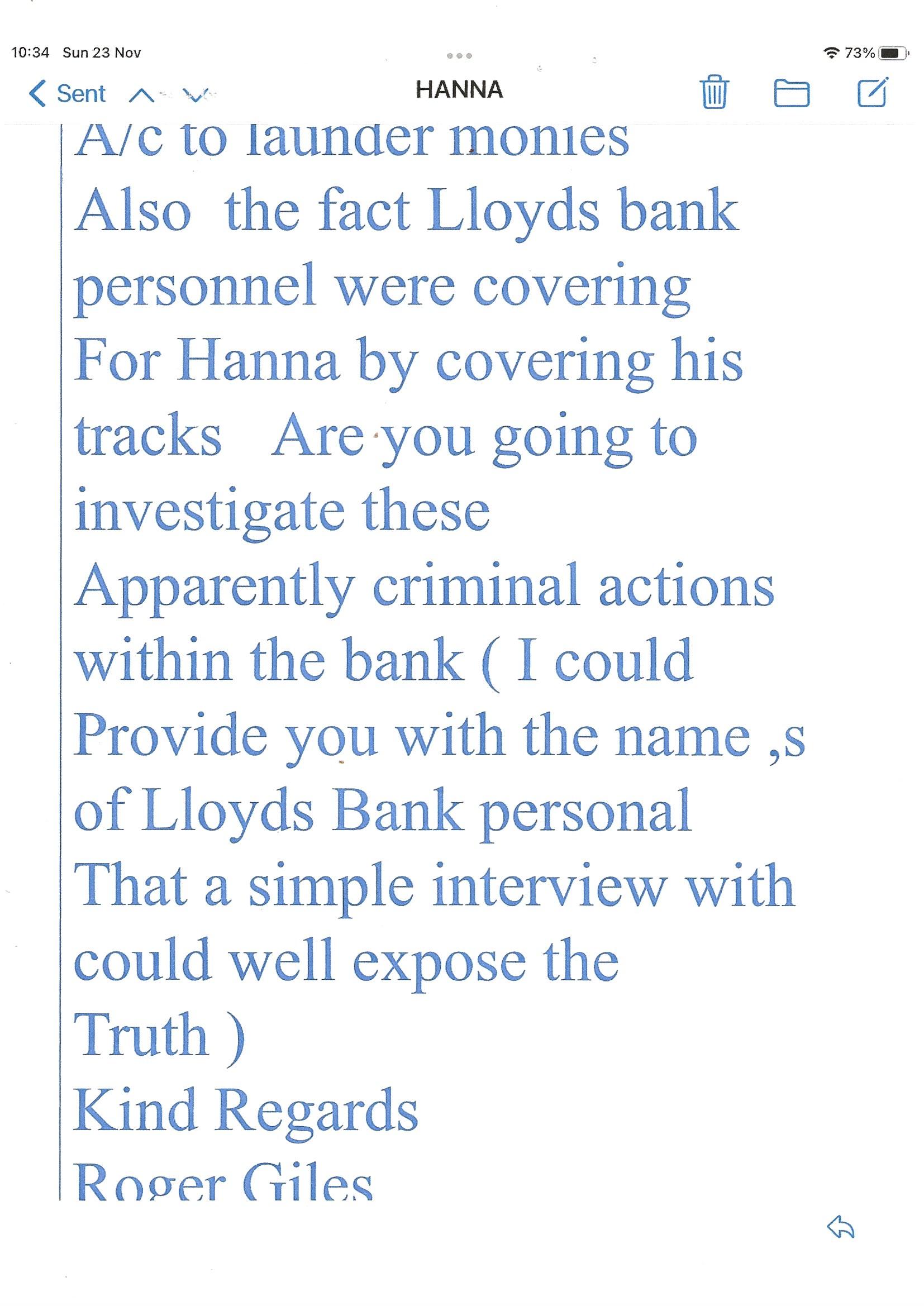

Figure 1 –

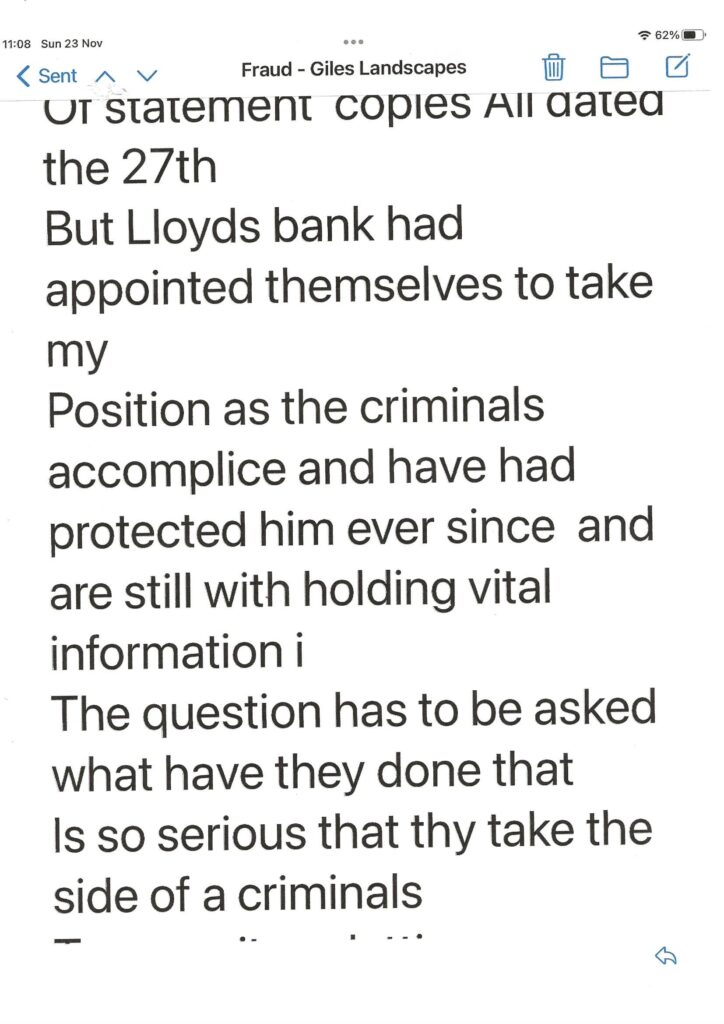

I made it clear to Superintendent Thacker that i had visited my bank on 27th November 2013 very concerned about possible criminal actions to a number 2 account that was under the umbrella of my company. As MD and owner i could be held accountable for illegal actions connected with my company. The bank instead of investigating the situation for me they bought in BSU who appeared to continually to want to cover up these criminal activities.

Recipients of the following page

Figure 2 –

This email was also sent to the same recipients of the above.

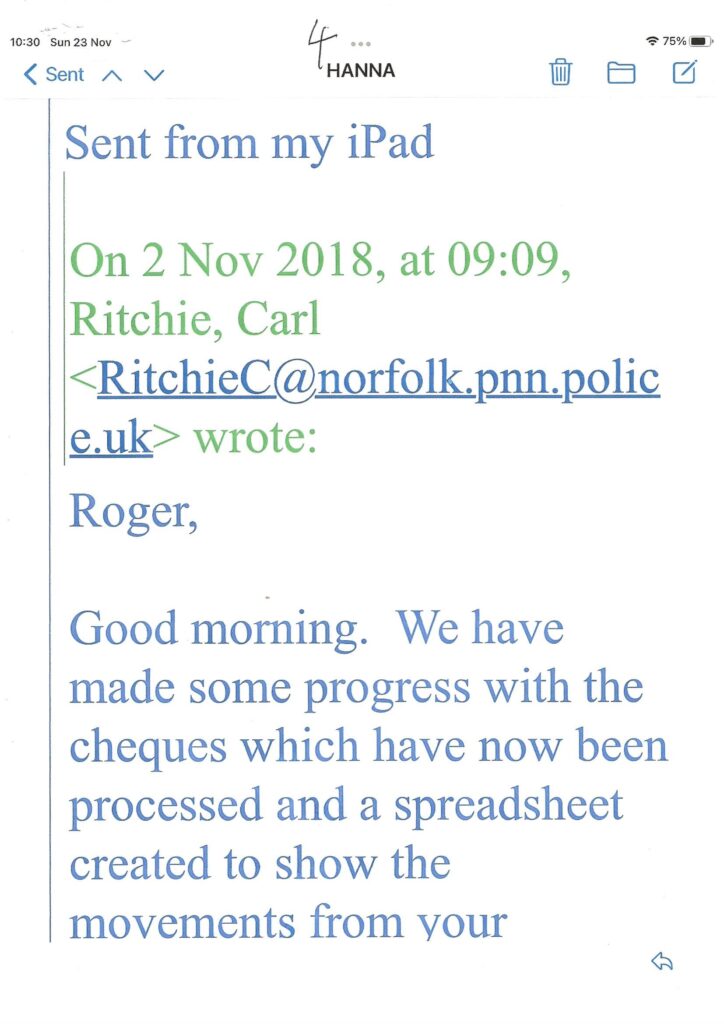

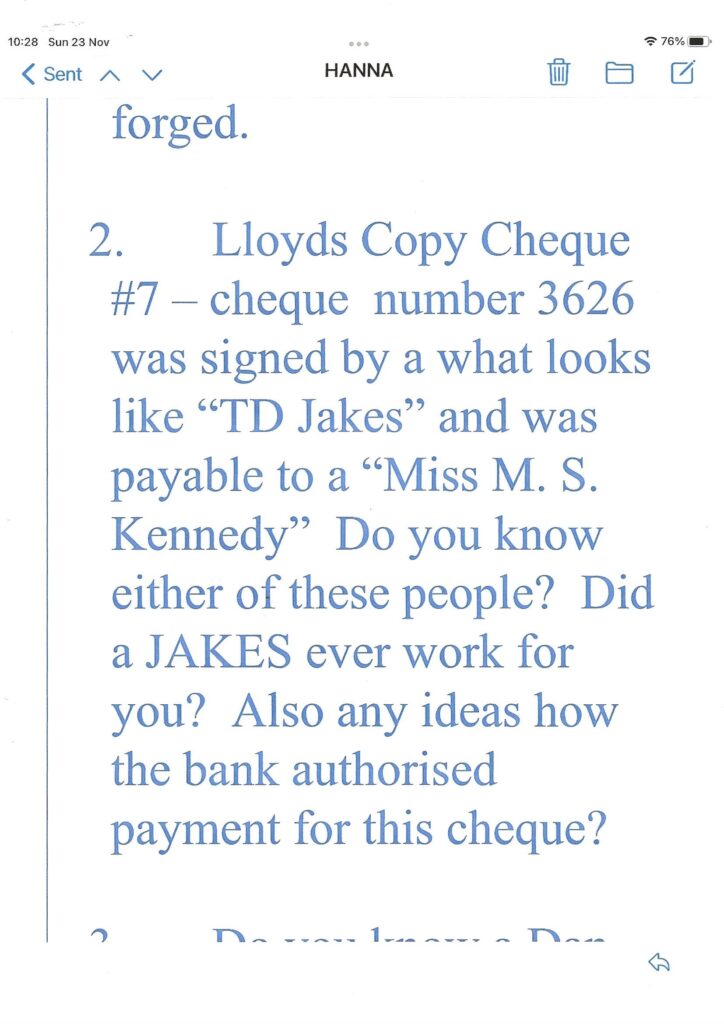

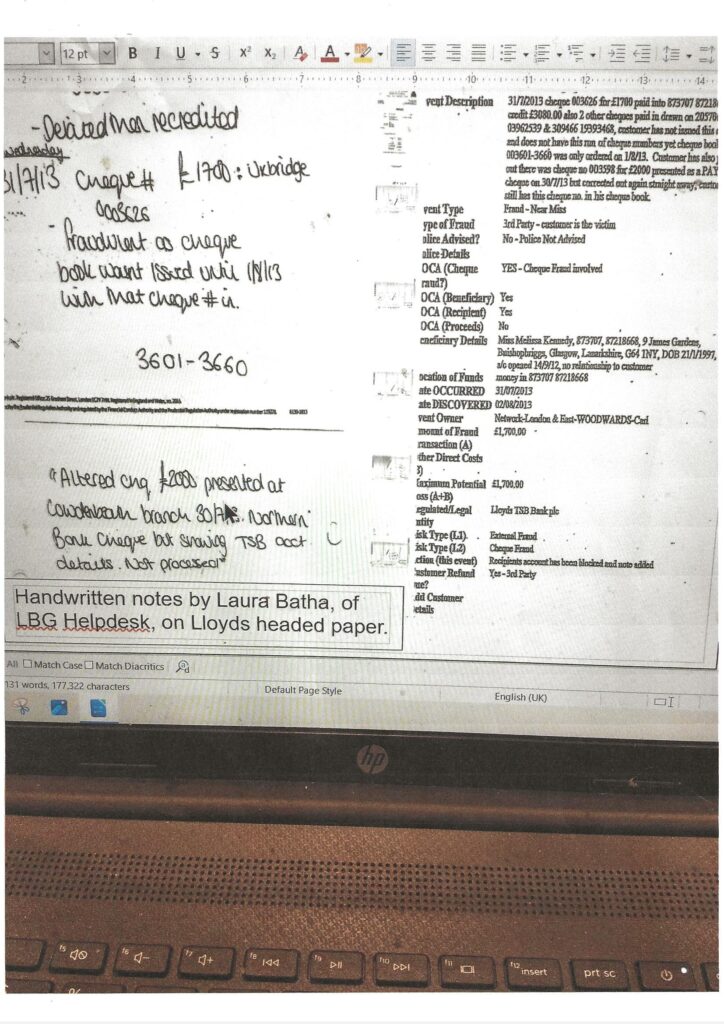

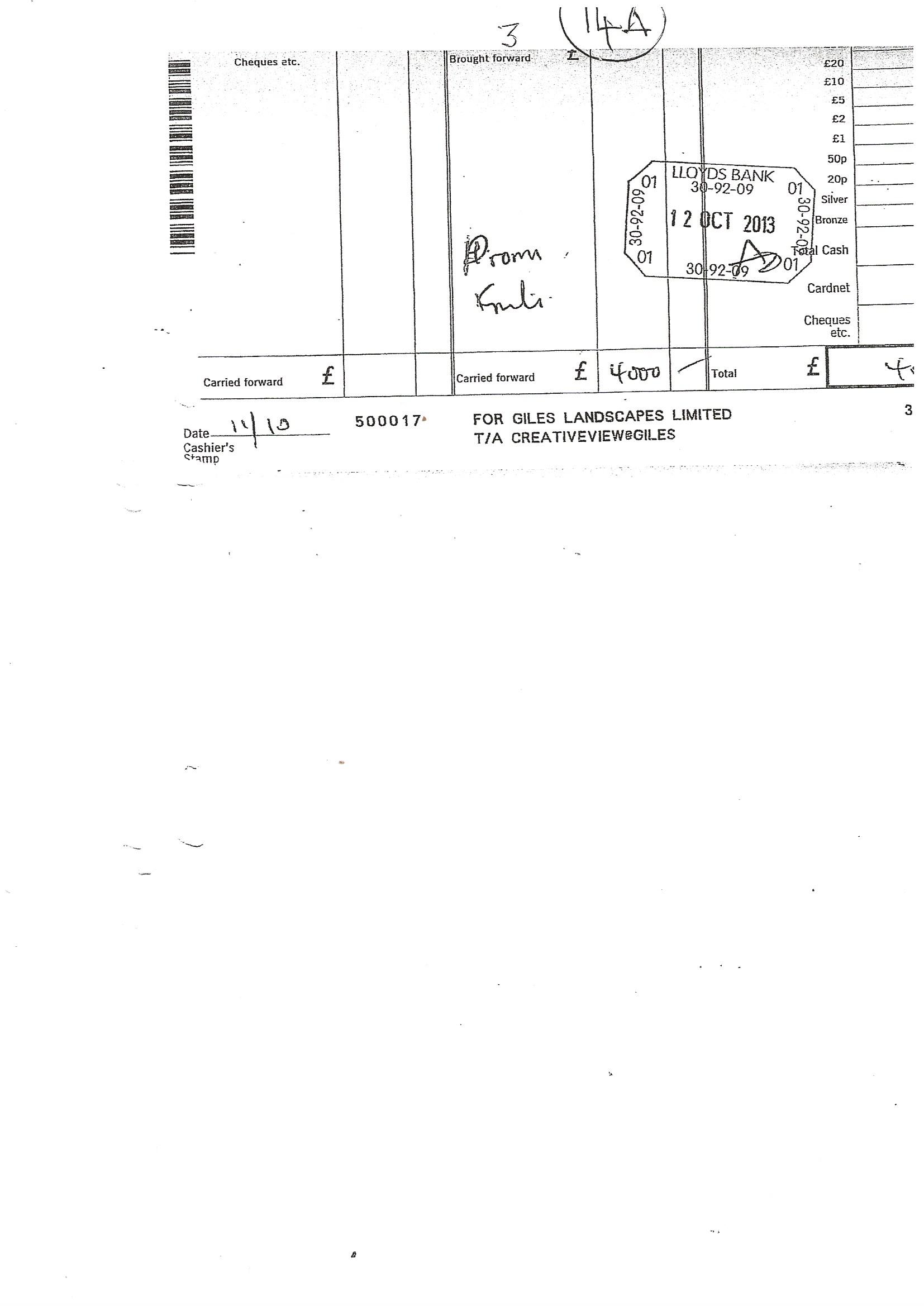

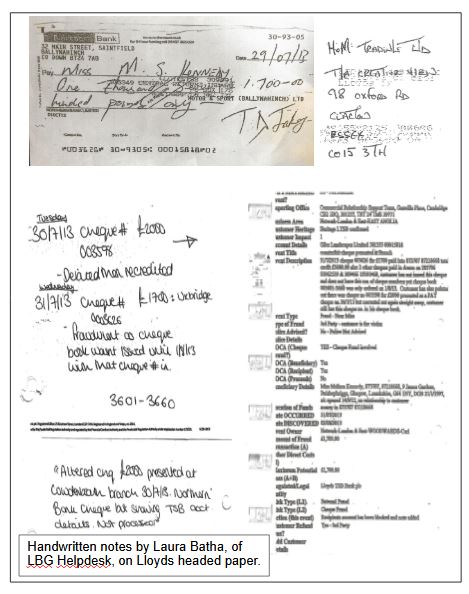

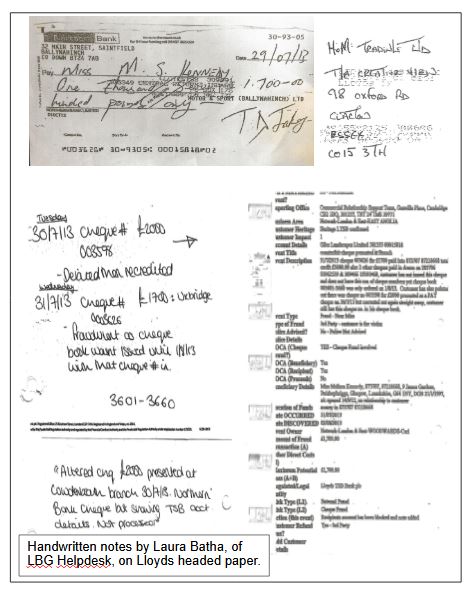

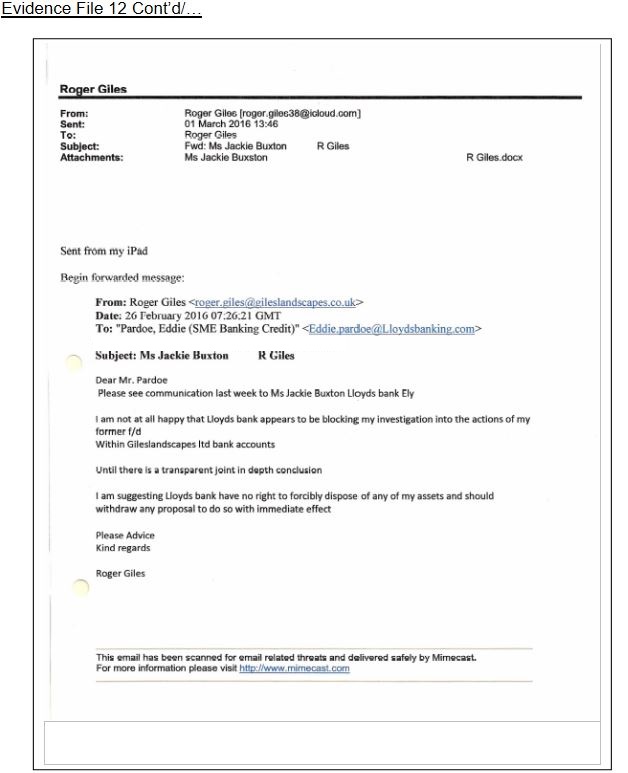

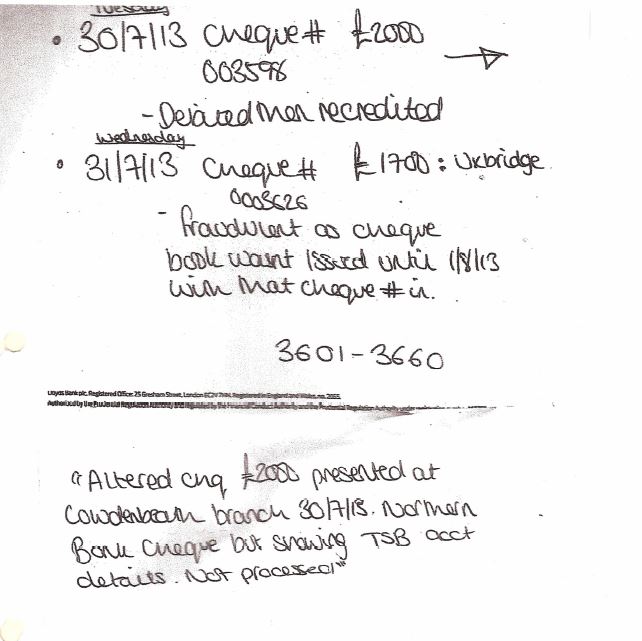

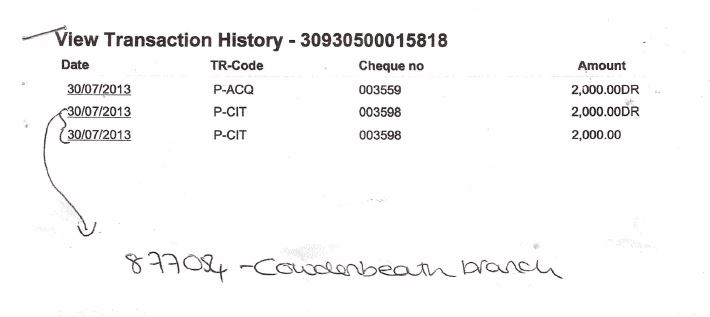

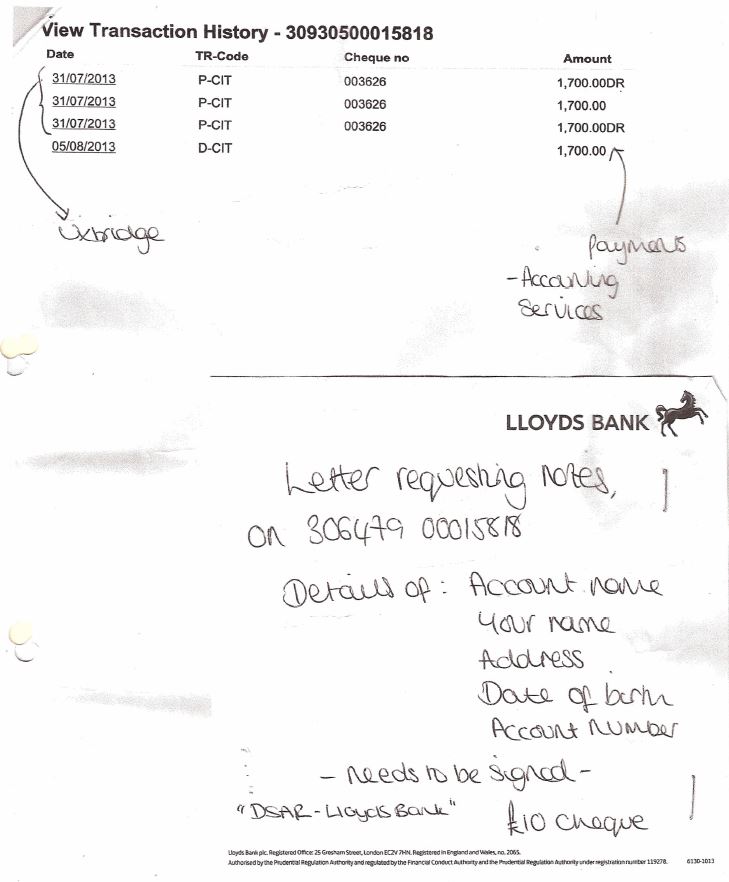

Detective Carl Ritchie is asking me the question about a cheque that went out of my account before the cheque book was issued. Lloyds could not redact a copy of this cheque because they knew i had already obtained a copy. Carl asked me the question what did i know about this cheque i knew very little because Lloyds were very economical with the truth on these matters. if the police had been more proactive they would have interviewed Lloyds Personnel to hear there side of the story. If you see in the below images i did get limited information from the helpdesk in Ely. But i was stopped by the senior manager Mrs Buxton from getting anymore information from the helpdesk. (Horto Osario instigated a letter to my MP that all the cheques had been paid out of my Number 1 account of Giles Landscapes had been paid out on the correct format.

Figure 3.

Police shy away from banks ( re well dc/sup thacker)

See my notes to Carl Ritchie DC (my first Police case) trying to get the police to interview bank personnel they must be under orders not to the evidence for my first and second police case were virtually the same my second case i was lead to believe was to ascertain who /were the Beneficiaries of illegal monies in point of fact on my second case (DC Andy Smith Lloyds Laura Batha was interviewed but the fact that police had lost the evidence she had provided it was pointless.

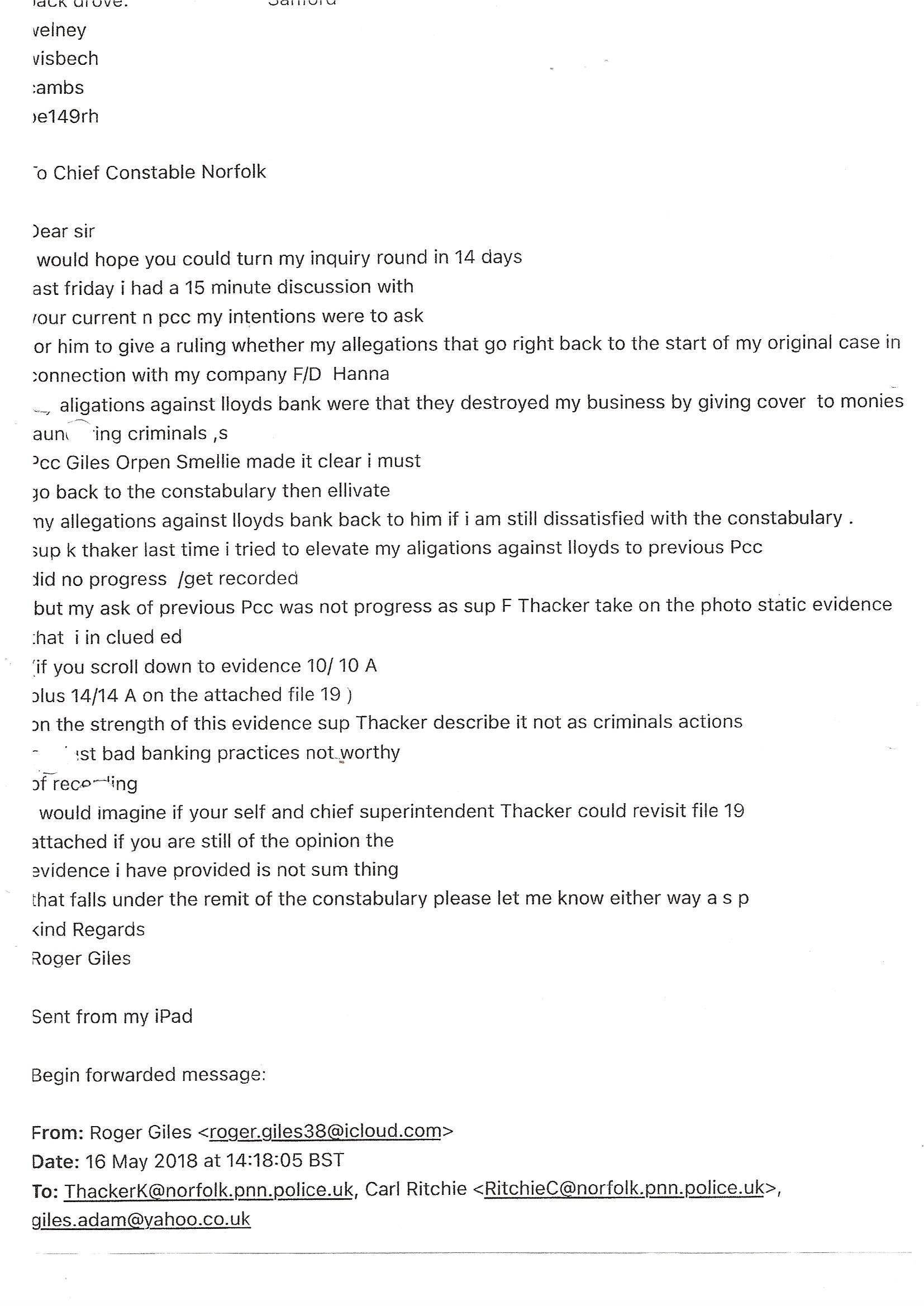

1

See re copied notes from my email to sup Thacker, when i realised the fact that’s it see very likely there was money laundering going on under the umbrella of my company i as the MD and sole owner would be held accountable i fully thought Lloyds would put in there risk team & if it was laundering the police would arrest me see my communication with sup thacker also see my communication with Norfolk chief constable stating that PCC Giles Orpen-Smellie sent me back to him in turn one of his juniors dealt with results were i was served with a professional standards vexatious violation plus to further rub salt in my wound sent me advise on how to fill in a Lloyds complaint form very similar to Andrew Bailey F C A sending me to the BBRS strongly manned by Lloyds personal

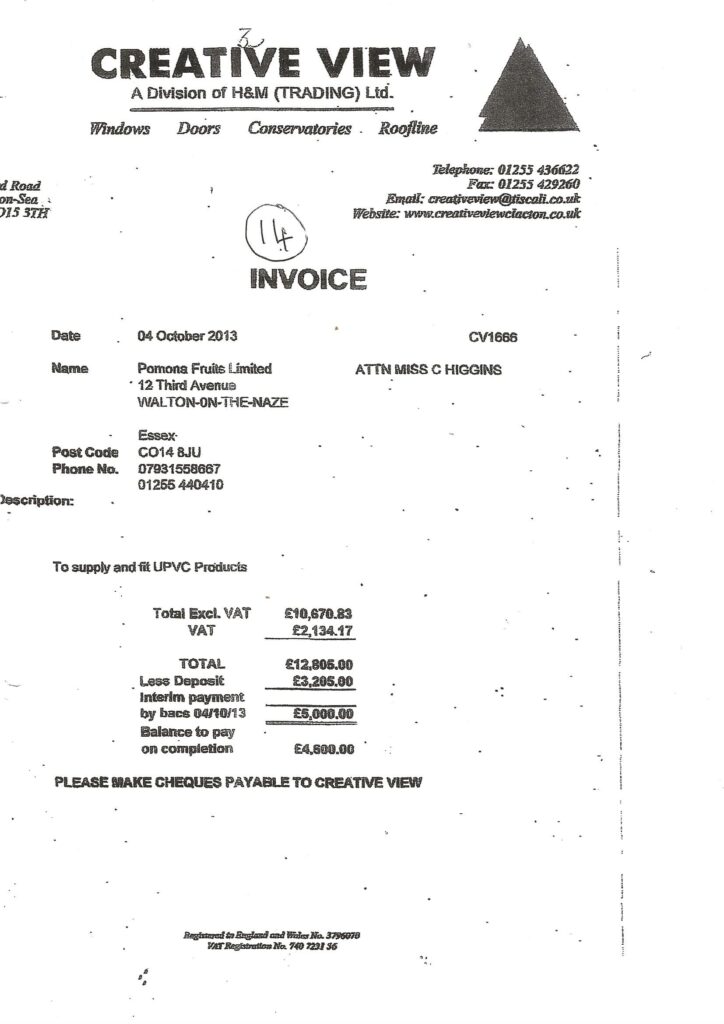

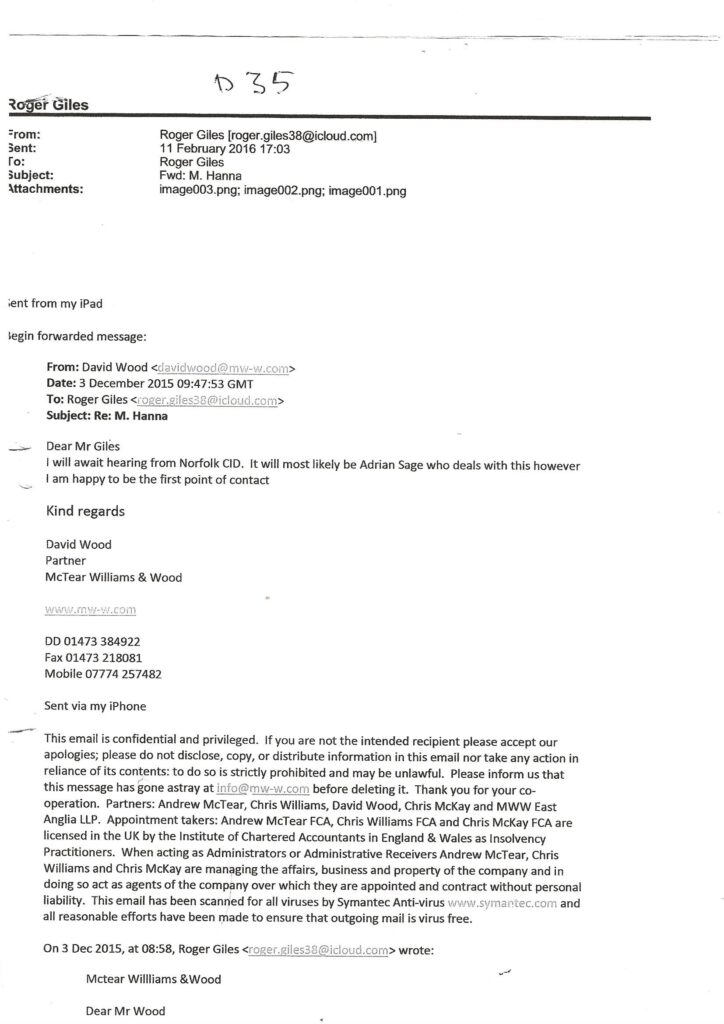

Also see this winding up 28 July 2013 order H&M (Trading) Ltd trading as creative view just before Creative View@Giles was opened

See the Creative View (East Anglia) Ltd started up 11 days after i went to see my manager about Giles@Creative View suspect account

Explanation from the above paragraph.

(Items sent back to me from this box mentioned, just look at the photo stat i am attaching) , Also see the USB memory stick that was sent back to me. This stick appears to be have wiped clean and the disc i sent in the jiffy bag has not been returned. On that disc there was file 12-31 each file held 5 – 10 pieces of scanned in evidence a normal layman would expect this stick was copied into the Police computer. On the memory stick there was also similar material listed file 19 and had numeral files about money laundering activates about me and another company linked to my financial director showing not only was a secondary account used under the umbrella of my company for the use of money laundering a third account was used to drain money from another company who was a Lloyds Banking customer in Essex. I also sent file 19 directly to Super Intendent Kathryn Thacker. se some evidence from that file below the jiffy bag

This letter was sent on behalf of Horto Osaria, By his man Mr Trood to the RH Liz Truss. You will see this statement is not true when you look at the above evidence this cheque went out of my account even before the specific cheque book had been issued to me. Also see bank notes from the Helpdesk Advisor in Ely, Cambs. Who was looking into this matter for me.

In 2018 then Detective Superintendent Kathryn Thacker (now T/Detective Chief Superintendent) wrote to you explaining that Norfolk Constabulary was not going to investigate this matter. You challenged this again with the Independent Office for Police Conduct (ref 2019/126291) and your complaint was not upheld.

T/D/C Supt Thacker explained to you that if was Norfolk Constabulary’s opinion that your complaint regarding Lloyds Bank Plc et al did not amount to criminal behaviour and instead was likely to be a civil/regulatory matter to be dealt with by the Financial Conduct Authority or as a Civil Legal matter.

From the material you have provided we see nothing further that would change this stance from the Constabulary. Norfolk Constabulary will not be investigating this matter. I am also aware that the original fraud linked to Hanna (36/5507/20) has now been concluded.

yes my original case was abandoned the police computer lost the evidences being sent through to CPS similar To Lloyds against Trevor Mealham’s trial at the Rowls Building last year the computer appeared to hold on to Lloyds evidence but had dumped Trevor’s evidence perhaps these computer are workings on horizon software

I do understand the frustration you must feel about this and I am sorry you have not had the outcome you had wished for. My suggestion would be for you to seek independent legal advice to see if there are any Civil remedies available to you. Please make contact with T/DC Andrew Smith who will arrange for you to collect the material you have provided to us.

Yours sincerely,

Richard

Richard Weller

Detective Inspector – CID West

N.B Andrew Bailey when he was CEO of FCA he has seen all this evidence and his reactions i probably would call now less than satisfactory. Please see this video of me talking to Andrew Bailey who is now the governor of the Bank of England. CLICK HERE on you tube (6:08) you can see me talking to Andrew regarding this whole matter

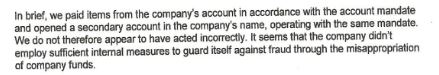

More information that the police computer should have had on it that DI Weller seemed unaware of i would like to be quite clear the letter instigated by Horto Osario of Lloyds Bank states Mr Giles cheques were paid out Mr Giles business account on the correct mandate and Mr Giles problem was caused by himself. Not having regulatory processes to monitor what was going on financially in his company. But in point of fact Mr Giles went to his bank manager of 10 years of 27th November 2013 flagging up his severe concerns financial anomalies especially in the secondary account this was 8 months before his company went down. If you see the evidence i have been provided if that had been given to me around the 27th November 2013 i could of stopped the criminals in there tracks. If you see the hand writing of my ex financial director on the top right hand side of exhibit 1 it is very similar to a cheque that went out of my account that i have show a copy of even before the cheque numbers were issued to my company.

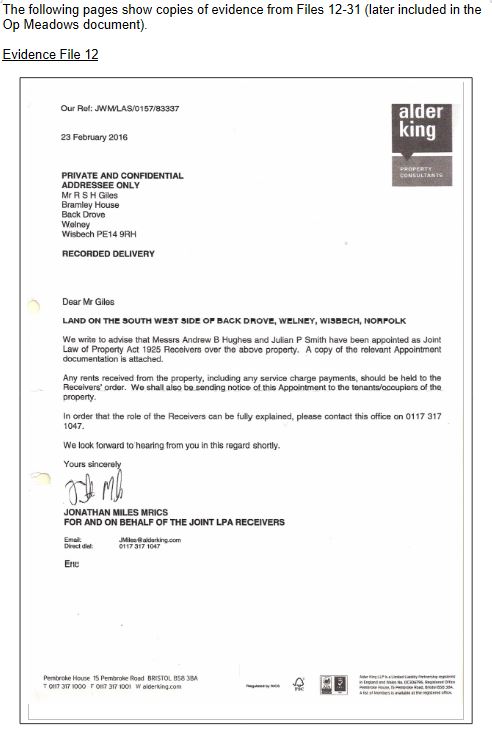

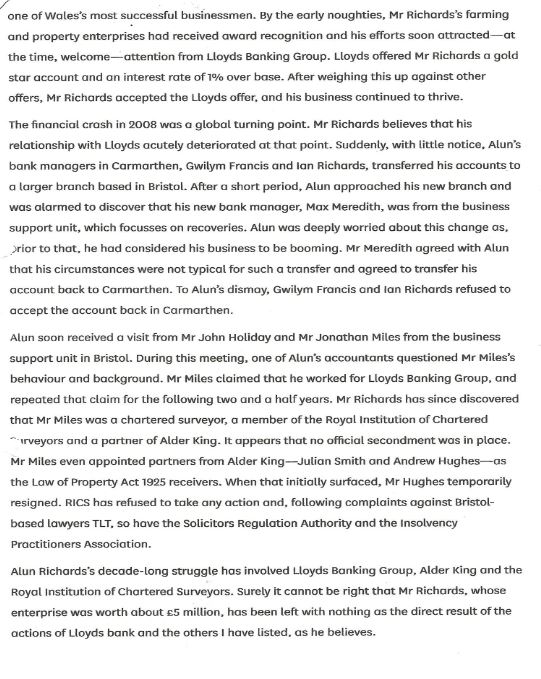

The below information mentions Jonathan Miles who is a known Lloyds Criminal see in WRAG/Handsard Debate 2018 were he is nefariously posing as a Lloyds Bank manager.

This batch of files from 12-31 each file holding many scans of evidence were sent on a disc to the Child Protection Office were my case was being run from on a disc in a jiffy bag that can be seen further back in this document it says DI Weller apparently has not seen this evidence or it is not scanned into the police computer. or alternatively the police computer has lost it it is just a general story again important evidence continually gets lost especially when it is in connection with Lloyds Bank.

The image to the left is a screenshot of material that was submitted to the police on a disc. This evidence appears to differ significantly from Detective Inspector Weller’s statement, in which he claimed there were only “a few bits of evidence in a box.” The disc, together with File 19, contained detailed information outlining indicators of money laundering and evidence of the same fraudulent activities being carried out against another victim through a separate Lloyds account titled Creative View.

It is therefore deeply concerning that Superintendent Thacker, despite being presented with clear evidence of these unlawful activities, chose to classify the matter not as criminal but merely as “bad banking practice.” This decision, particularly given her senior position (now Chief Superintendent), appears to have set a precedent that directly contributed to my case being closed. The handling and classification of this evidence warrant urgent review, as they suggest serious procedural and evaluative failures within the investigation.

See File 23 exposing Lloyds lies re. Mr Giles Cheque’s we’re paid out on correct mandate. (Below). My experiences of all this evidence which i have provided to the Norfolk Police has been downgraded to bad banking practice not criminal activity or alternatively completely ignored. This file 23 which you have seen some excerpts from below has 12 other documents mainly connected to the nefarious activities of Lloyds Bank

My Continuing Quest for Justice which is on Par with many other victims.

Generally this is to show that in my opinion anybody who attempts to gain fair play and justice from the banking industry and any other financial banking institutions in the UK comes up against a brick wall, were people appear to have unlimited monies in the case of the banks they were bailed out by the tax payers of this country. it seems to have given them licence to use the money and the status they have gained from the tax payers to steal asset’s of SME’Ss and entrepreneurs who should be the back bone of financial resurgent it the UK.

Below can be found my email correspondence between me and the Norfolk Police. Click below to view.

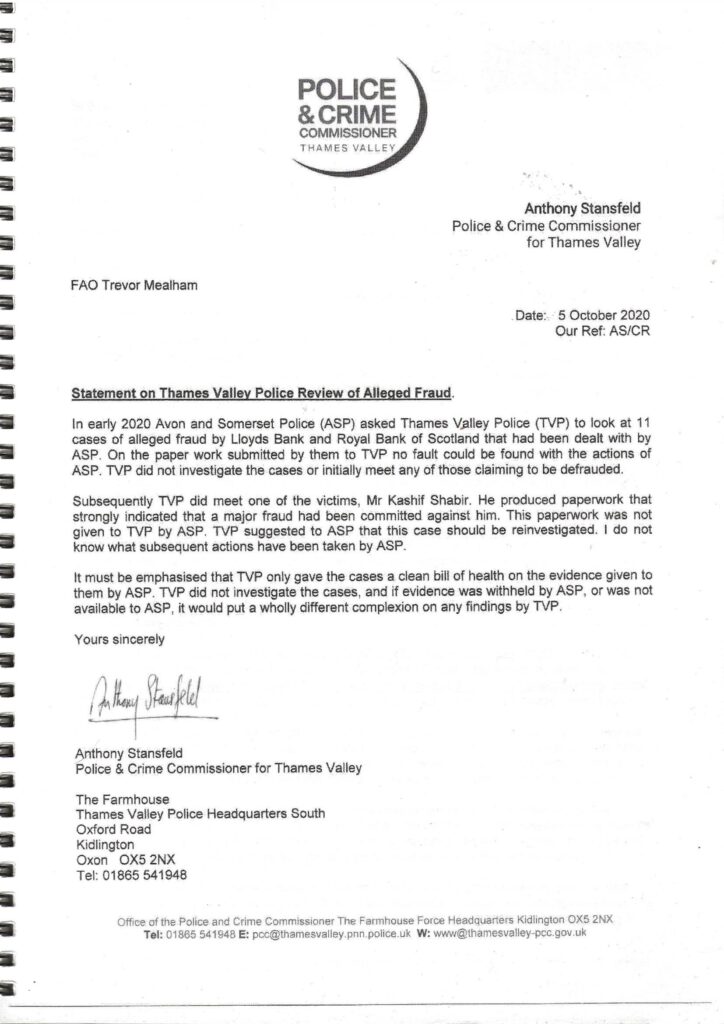

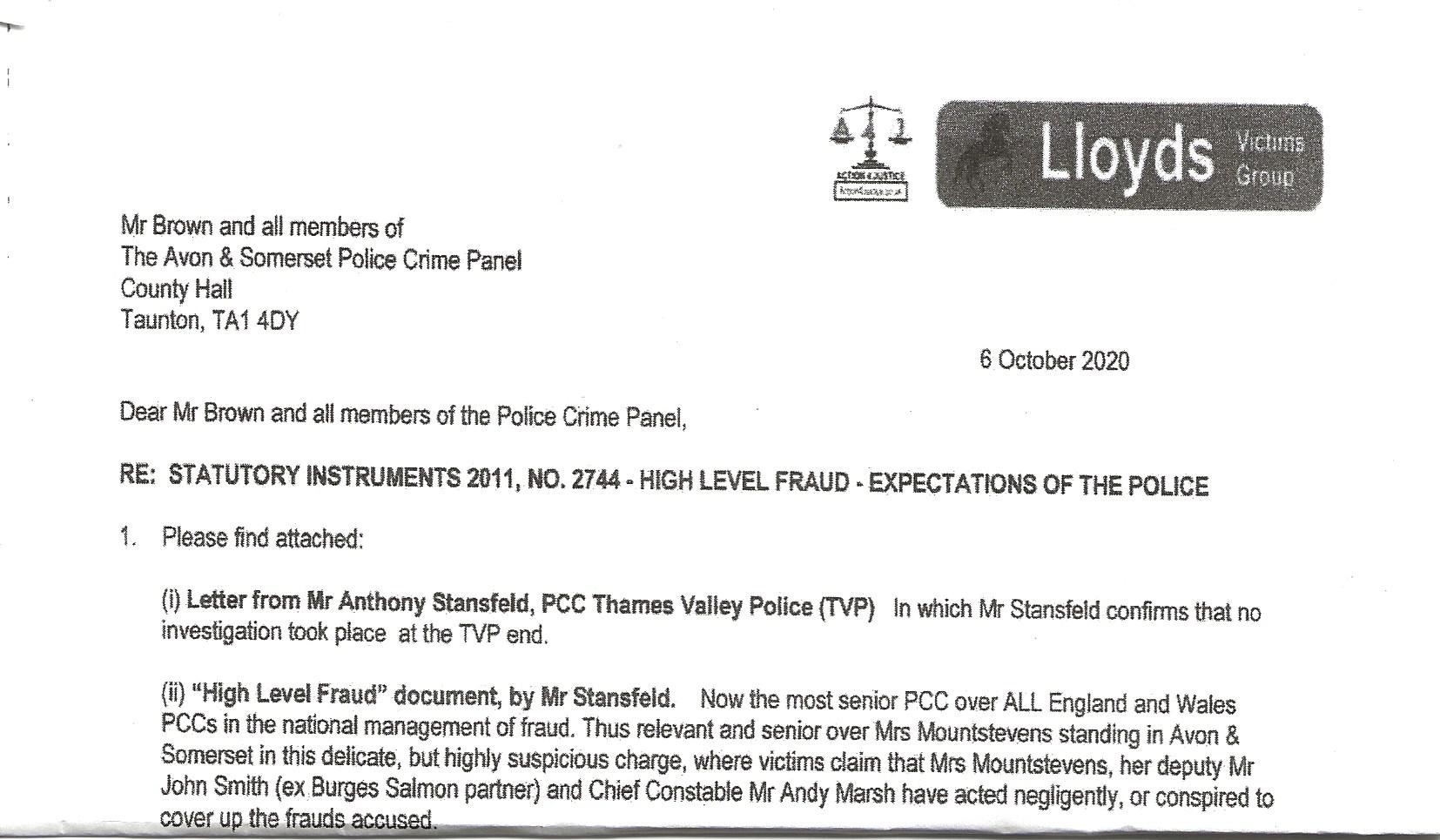

It seems that Norfolk Police and Crime Commissioner Lorne Green had a similar attitude to Mrs Sue Mountstevens Avon & Somerset Police and Crime Commissioner. Where similar to my situation documents in this case below in connection with Mr Shabir appear to have gone missing. I think it will be self explanatory in my case the majority of documentation i gave to the police seem to disappear or be disregarded.

See details that appear to show even after PCC Anthony Stansfeld flagged up these discrepancies no investigation seems to have taken place.

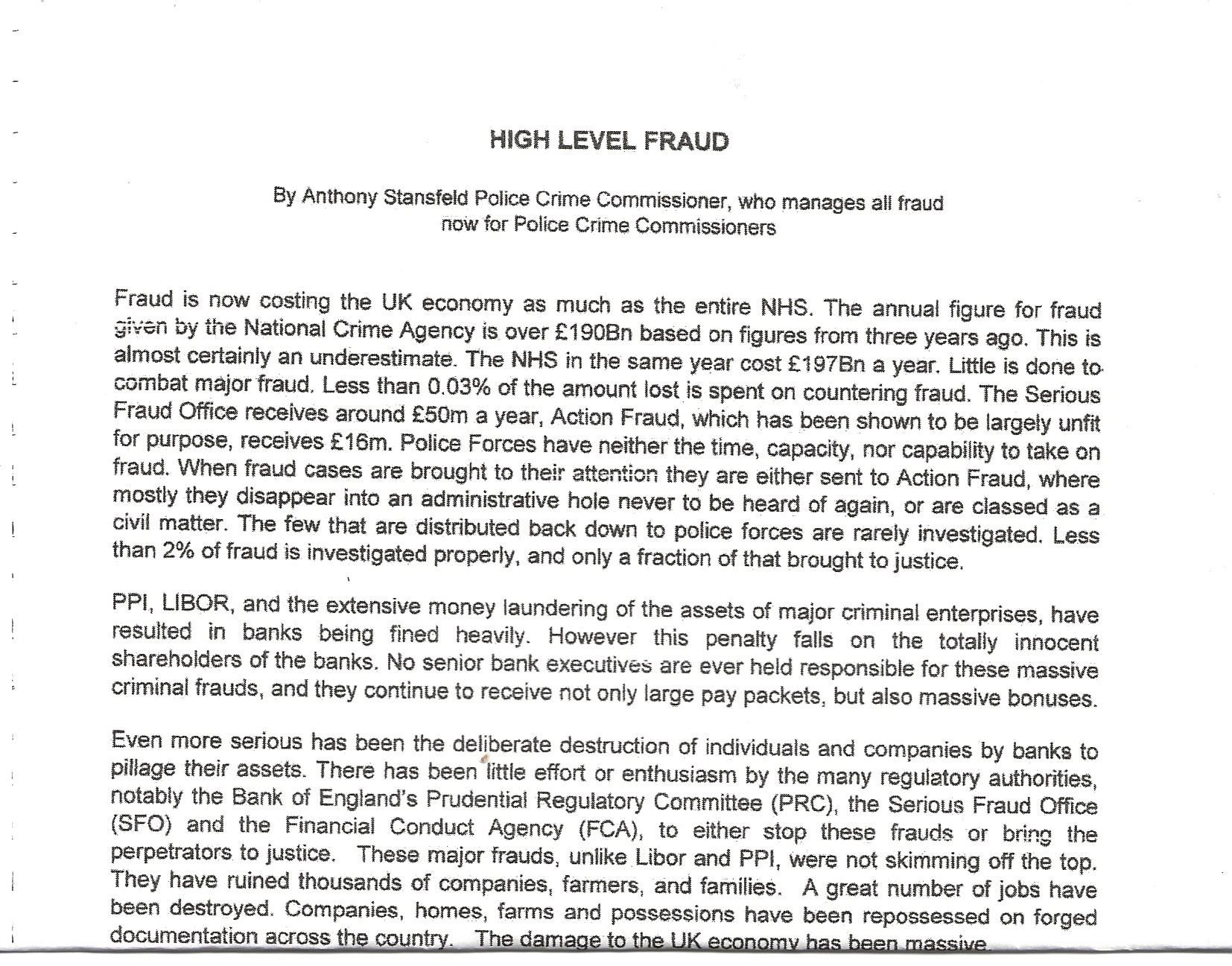

Please see details that PCC Anthony Stansfeld is flagging up the cost of this banking crime to the UK and devastation it causes to SME’s and in some cases larger businesses.

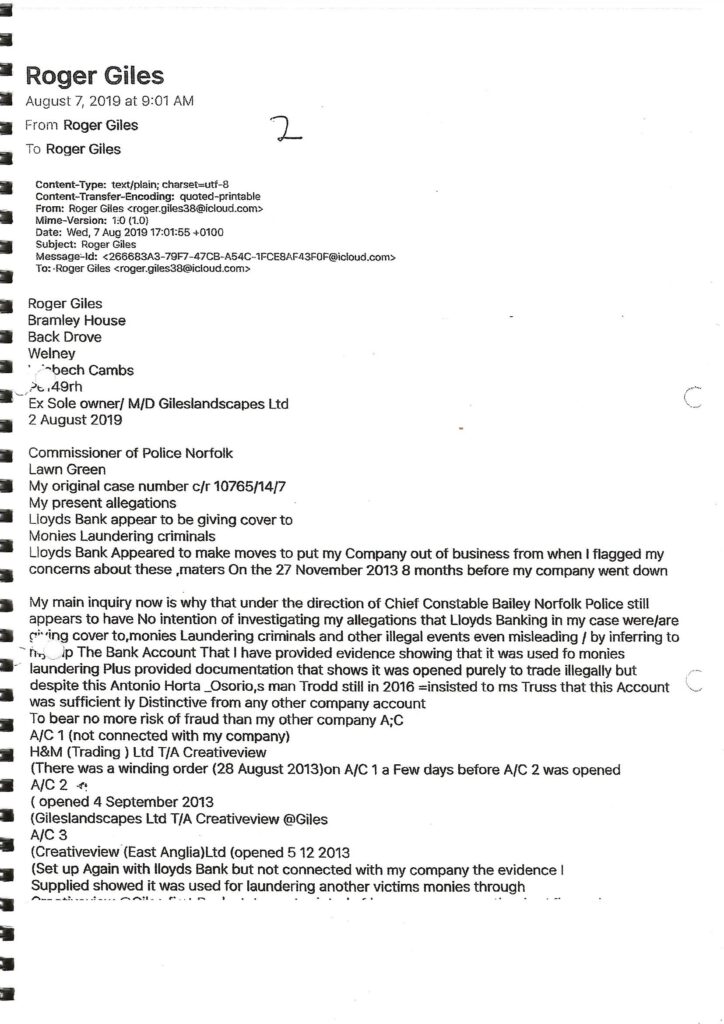

My cry for help from PCC Norfolk – Lorne Green. Seem to become rather confusing and i did not feel sure that Lorne Green had seen the documentation i had sent.

See me trying to get clarification whether the documentation i had sent had been put in front of Lorne Green.

It seems that i have served a notice for abusing the system.

Impact on the Local Community

These photos supplied by kind permission of Peter Cox.

Peter Cox’s Lorry his business is normally delivering literature to government departments but on this occasion he give as windows to help us out to get the Chelsea Flower Show sorted.

Steve Kerr local carpenter he assisted us to build a essex wild life trus t building with sedum green roof building /office made of cedar wood to be added into the garden

Steve Kerr local carpenter he assisted us to build a WWT office made of cedar wood to be added into the garden.

(Above) This is the side of the Cedar wood cabin which was used as the essex wild life trust office. It also displays the Rooterium/Driftwood archway which leads into an orchard behind. Note the ground has been prepared to take the wildlife meadow that we would peel of the doors and put into situ without any set back.

Organisation and business sparked / supported each other and the community see photos above of Peter Cox who took over our transporting arrangements regarding the Wildlife Trust Lush Garden at the Chelsea Flower Show. Being Ex Military Peter could organise the operation with perfect timing he would leave the Lamb & Flag Car Park dead on 4:30am guaranteed him being the first one in the thames gate of the Chelsea Pensioners Garden. As a result we would then have first pick of Chelsea Unloading Forklift gear to unload. Our Wildflowers Meadow was loaded onto his lorry sliding the doors it was grown on, to Dutch trollies as can be seen re pictures of his curtainsider this method gave us instant Wild Flowers meadows clearly the best in show plus the second picture please see the Cedar Wood Wildlife trust visited centre building that was part of garden with Steve Kerr our village carpenter built and assembled. Another asset in the village was local business Loveday Engineers that fashioned any steel fabrication that was needed. There was also an advantage of Sir Peter Scott’s WWT for consulting on environmental advice we were together a great team in business and social commitment for instance Peter Cox plus Loveday Engineers and the interpretation manager Debbie MacKenzie WWT and Steve Kerr Local Village carpenter whose band was called against the grain played at the village gala plus my company sponsored Fen Skating Club altogether we sponsored and ran the Welney Gala in 2004 raising £4K for Village Funds even the local Fen Ben mistery character came out of hiding and compared the Gala, but this team and local comradery fell out of bed when Loveday’s 2 original businesses and mine capitulated in connection with Lloyds BSU destruction. I am just trying to portray when genuine businesses with high social commitment go there are often repercussion on the community. For instance Loveday Engineers underpinned the Cricket team for 15 years , my business did the same chair of fen skating for the Fen Skating. Also Loveday engineers and my own business being the main businesses were strong instigators of local money raising events when we fell out of bed all this deteriorated ‘ plus this fenland community had the lost the advantage of my business promoting sport and free NVQ apprenticeships inhouse for local people. There is a slight light on the horizon my original business that was bought out of administration in 2014 & run b\y CMS located in St Ives but the business has now fully moved back to our village of Welney again employing some 30 staff plus John Loveday has started up again as Dem sports selling cricket cages all over the world so local employment is picking up again oaso there village housing develop appearing bringing village numbers up, changing back from a retirement type village to thriving balanced community, but the down side is the Village School, Post Office / convenience store and sporting facilities have gone even the isle horticultural college Wisbech has now closed down [ this was a good send to late developers from the village and a big boost to my business quality operatives ] but new blood moving in is working with locals promoting change & improvement we again have a thriving church & pub. The resilient fen community is now showing signs of reinventing itself.